richmond property tax rate 2021

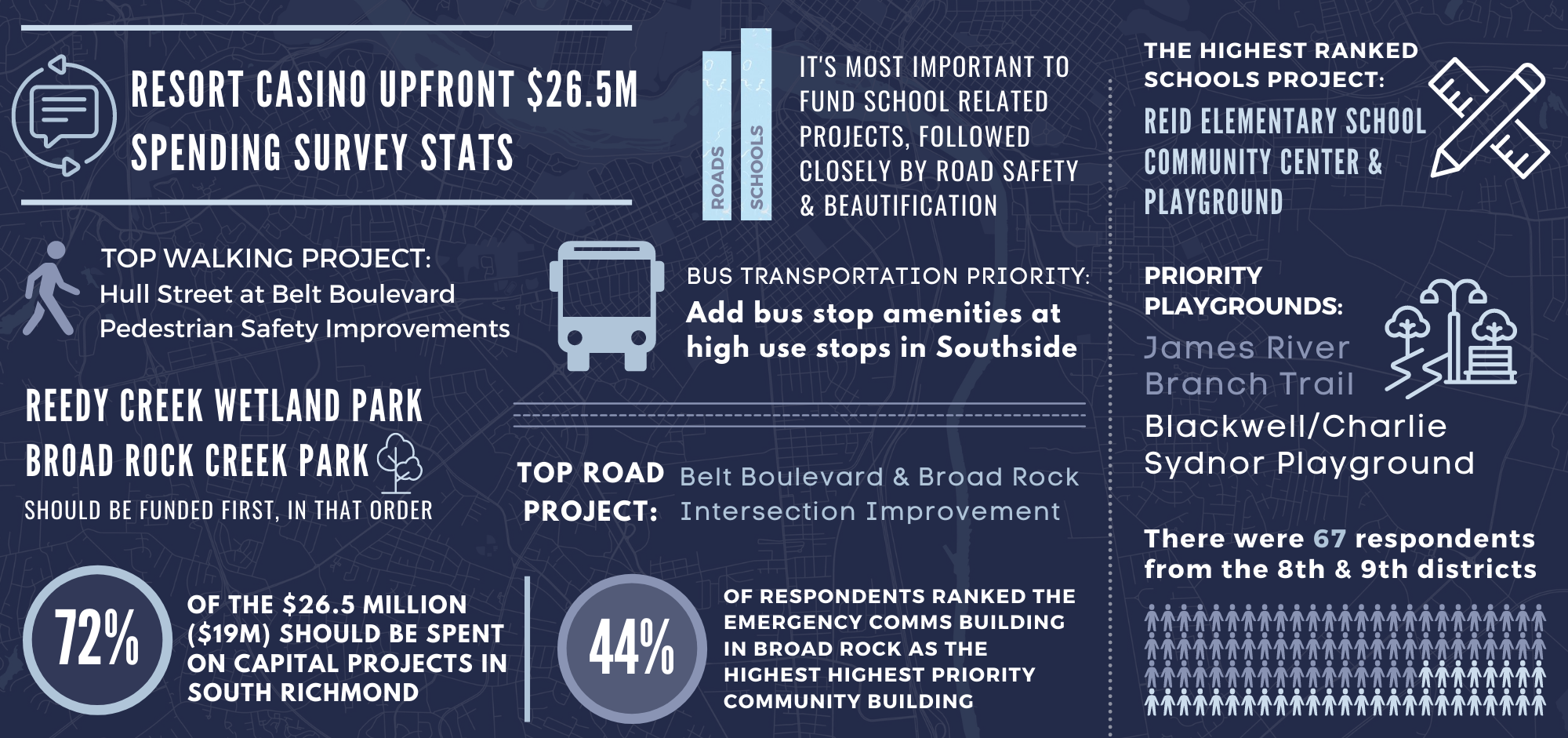

1000 x 120 tax rate 1200 real estate tax. The tax rate for FY 2021-2022 is 380000 cents per 100 assessed value.

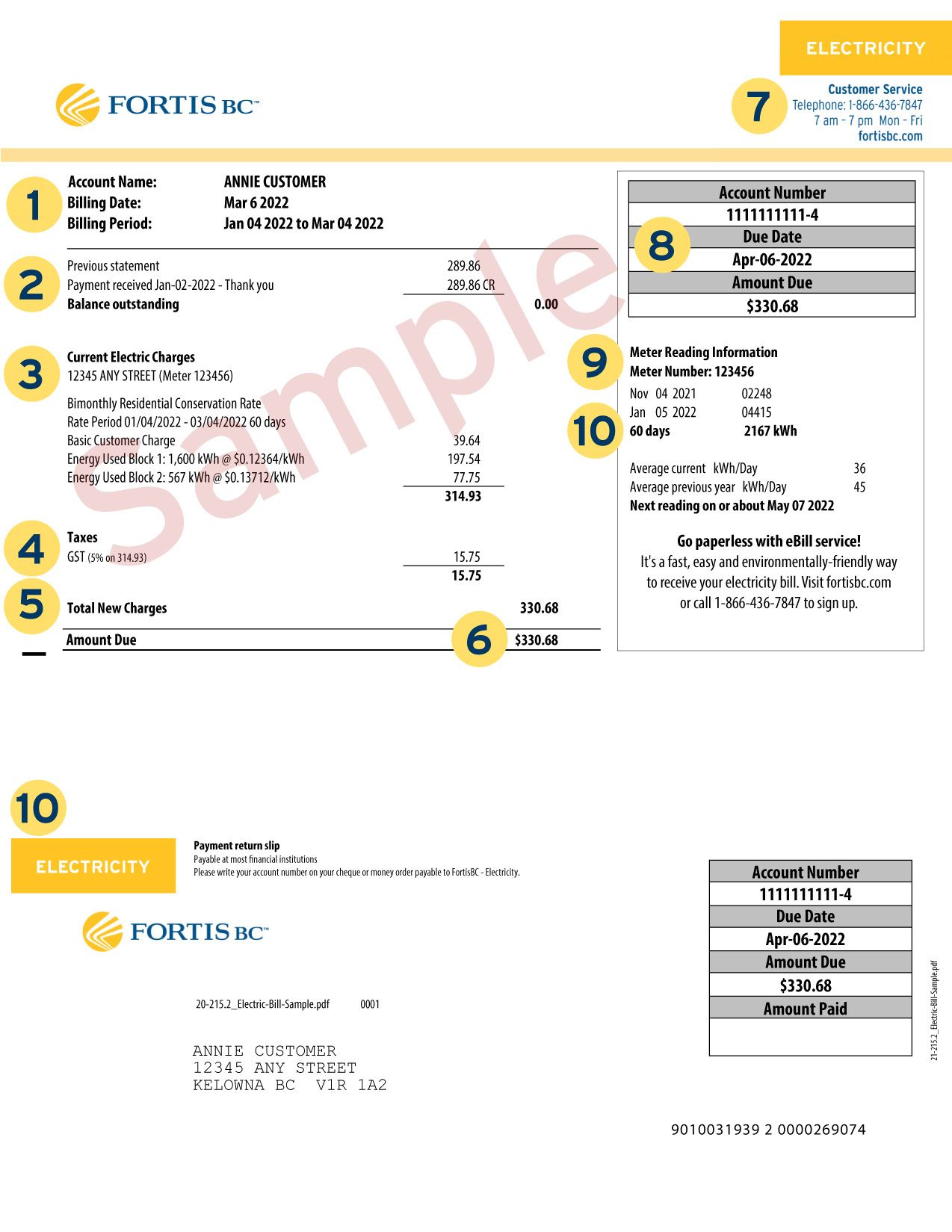

How To Read Your Electricity Bill

2022 Tax Rates.

. Ad Get Record Information From 2021 About Any County Property. What is the real estate tax rate for 2021. Learn all about Richmond County real estate tax.

Vehicle License Tax Antique. While I appreciate sound fiscal management 2021 is not the time to burden the residents of Richmond with a tax increase. This information pertains to tax rates for Richmond VA and surrounding Counties.

To view previous years Millage Rates for the City of Richmond please click here. Property Value 100 1000. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

FY 2021 Rhode Island Tax Rates by Class of Property Tax Roll Year 2020. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established. 2021 Richmond Millage Rates.

Tax Rate 2062 - 100 assessment. How are residential property taxes divided. Richmond Hill accounts for only about a quarter of your tax bill.

2 1000 of assmt value between 3M to 4M 0002 Tier 2. Region of York - 50 per cent of property taxes. The rates will be adjusted for 163 cents on each 100 of personal property and 134 cents on each 100 worth of real.

Tax Rate 2062 - 100 assessment. School Boards - 23 per cent of property taxes. Over 4M 4 1000 of assessment value over 4M 0004 City of Richmond 2021 TAX RATES New Additional School Tax for Qualifying Residential Properties.

Vehicle License Tax Vehicles. If you have an issue or a question related to your personal property tax bill call RVA311 by dialing 311 locally visit. This year the city chose to select the compensating rate for the 2021 rates.

By Richmond City Council. What is considered real. Whether you are already a resident or just considering moving to Richmond County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

June 5 and Dec. Lets find out using the 2021 tax rolls. Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February 28th.

Richmond Property Taxes Range. Ultimate Richmond Real Property Tax Guide for 2021. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp.

We need to give people time to get back on their feet. Depending on your vehicles value you may save up to 150 more because the city is freezing the rate. 3470 apartments 6 units.

Tax Rate 2062 - 100 assessment. It is estimated that by freezing the rate the city will provide Richmonders more than 8 million in additional relief. The City Assessor determines the FMV of over 70000 real property parcels each year.

RICHMOND 2 6 2038 2038 2038 2264 SCITUATE 6 1827 2267 3892 3020. Amelia County 804 561-2158. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead.

However with rising property values a 250000 home will see an increase of about 2425. Average Property Tax Rate in Richmond. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

What is the due date of real estate taxes in the City of Richmond. Given the Citys tax rate of 120 per 100 of assessed value thats 886 million in foregone tax revenue. Personal Property Taxes are billed once a year with a December 5 th due date.

Year Municipal Rate Educational Rate Final Tax Rate. Richmond Property Taxes Range. Learn about Richmond Hills budget.

Richmond Hill - 27 per cent of property taxes. Richmond property tax rate 2021 Monday June 13 2022 Edit The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

Real Property residential and commercial and Personal Property. The residential tax bill is divided as follows. Property value 100000.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. A tax increase will be an extra burden on homeowners as well as on small business and renters whose landlords will pass on the added taxes to them in future rent. Residential Property Tax Rate for Richmond Hill from 2018 to 2021.

West Warwick - Real Property taxed at four different rates. 105 of home value. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

The real estate tax rate is 120 per 100 of the properties assessed value. Within Richmond city limits a total of 3223 parcels constituting more than 8500 acres valued at some 74 billion are identified as tax exempt meaning they pay no property taxes at all. This year the city chose to select the compensating rate for the 2021 rates.

Personal Property Registration Form An ANNUAL. Richmond City has one of the highest median property taxes in the United States and is. Vehicle License Tax Motorcycles.

Real estate taxes are due on January 14th and June 14th each year unless the dates fall on a weekend or holiday in which case the taxes will be due on the next business day. Based on latest data from the US Census Bureau. The total taxable value of Richmond real estate rose 73 percent in new tax assessment notices mailed to city property owners this week the biggest year-over-year increase in a decade.

Find County Online Property Taxes Info From 2021. Over 4M 4 1000 of assessment value over 4M 0004 City of Richmond 2021 TAX RATES New Additional School Tax for Qualifying Residential Properties. Between 3M to 4M.

Tax Rate per 100 of assessed value Albemarle County 434 296-5856. This year the city chose to select the compensating rate for the 2021 rates. Car Tax Credit -PPTR.

Yearly median tax in Richmond City.

Richmond Hill Property Tax 2021 Calculator Rates Wowa Ca

Henrico S Moon Shot Richmondmagazine Com

Garbage And Recycling City Of Richmond Hill

Opinion Vancouver City Council S Ideas To Reduce Car Traffic Out Of Touch Urbanized

Why Richmond Hill City Of Richmond Hill

Mississauga Boasts 11th Lowest Property Tax Rate In Ontario Insauga

Why Richmond Hill City Of Richmond Hill

1099 G 1099 Ints Now Available Virginia Tax

Mississauga Boasts 11th Lowest Property Tax Rate In Ontario Insauga

Trees And Yards Lawn Watering Restrictions City Of Richmond Hill

Taxation The Municipality Of The County Of Richmond

The Best And Worst Cities To Own Investment Property Gobankingrates

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

City Council Approves 3 Tax Increase For 2022 Prince George Citizen